CitiMortgage Bill Payment:

At Citibank, they comprehend that you need various kinds of home loan items at various phases of life. A home loan credit goes far in financing your aspirations. Their contract items are stuffed with highlights that will supplement both your way of life and monetary objectives.

Regardless of whether you taking a gander at purchasing another house, redesigning your current home, putting resources into the property, or moving your current credit, Citibank presents to you the most extensive scope of home loan advance arrangements with various home loan advance rates to make your fantasy home a reality.

Why Choose CitiMortgage:

- Regardless of whether you’re a first-time home purchaser, putting resources into your fantasy home, or changing homes, they have the correct home credit offering to suit your necessities.

- Move your significant expense credit to Citibank and diminish your regularly scheduled payment trouble. You can likewise profit improvement on your advance for extra necessities.

CitiMortgage Online Bill Payment:

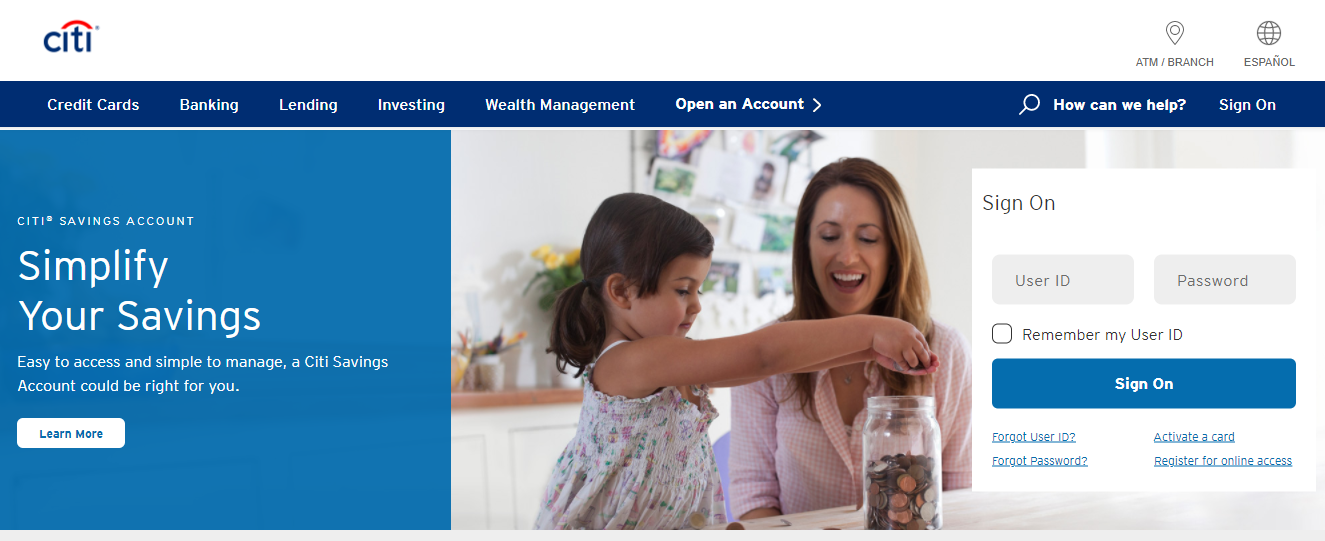

- For the online bill payment open the page online.citi.com

- As the page appears at the center you have to provide the user ID, password.

- Now hit on Sign on’ button.

- After the login, you have to follow the prompts and increase the credit limit.

How to Retrieve CitiMortgage Login Details:

To retrieve the login details, open the page, online.citi.com

- Once the page appears under the login spaces click on the ‘Forgot user ID’ button.

- You have to select the action you want and proceed with the prompts.

- For password recovery follow the prompts.

How to Register for CitiMortgage Account:

- To register for the account open the page, online.citi.com

- As the page appears in the login widget tap on the ‘Register for online access’ button.

- On the next screen follow the prompts.

CitiMortgage Bill Pay by Phone:

- You must have the payment details and pay the bill through phone number.

- You have to call on, 1-866-272-4749.

CitiMortgage Bill Pay by Mail:

- You can also pay the bill through the mail. You have to send the bill to the particular address.

- Send it to, P.O. Box 78015, Phoenix, AZ 85062-8015. Overnight Address: 4740 121st Street, Urbandale, IA 50323-2402. Payoff Address: 4740 121st Street, Urbandale, IA 50323.

Also Read : Payment Guide for Maurices Credit Card

Types of CitiMortgage:

- Fixed-Rate Contract: This credit alternative is accessible in 10-year, 15-year, and 30-year terms. The 30-year fixed-rate contract is the most well-known home loan alternative for purchasers in the U.S., as per Freddie Mac.

- Customizable Rate Contract: An ARM remains as opposed to a fixed-rate contract in that the financing cost connected to the credit can vary over the advance’s life. By and large, the financing cost is lower for a starting period than it would be with a fixed-rate advance.

- Bureaucratic Housing Administration: This is an administration guaranteed credit which is accessible as either a fixed-rate or flexible rate contract. On the off chance that you have restricted pay, a low FICO rating, under 20% for an initial installment, a restricted business history or are independently employed, this might be a brilliant alternative for you.

- VA Advance: The advantages of this advance, which is ensured by the Department of Veterans Affairs, incorporate no initial installment prerequisites, serious loan costs and low shutting expenses and charges. On the off chance that you are a current or previous individual from the U.S. Military or National Guard, you might be qualified for this home loan.

- Enormous Credit: This kind of advance is ordinarily used to purchase a costly home. The advance sum needs to surpass the adjusting credit limit for it to be viewed as a large advance. In a large portion of the U.S., the 2020 adjusting advance cutoff is $510,400, yet in certain significant expense regions, that breaking point could be higher. A gigantic advance has a higher financing cost, may require a bigger initial installment and a lower credit to-esteem proportion than regular home loans.

- Grand slam Mortgage: Citi offers contract programs for low or moderate pay borrowers. The Homerun program is accessible to you on the off chance that you procure 80% or not exactly the zone middle pays. With financing costs tantamount to typical mortgages, an upfront installment as low as 3% and no home loan protection necessity, this is an appealing choice.

CitiMortgage Contact Details:

For more mortgage details you can call on 1-800-248-4638.

Reference Link: